Inspection and indemnification

Inspection and indemnification

As the owner of a shipment (or an insured object), you must have standby yourself with the insurance to protect yourself and your goods (or products) in the event of an accident. any unfortunate incidents occurred during the purchase and shipping period.

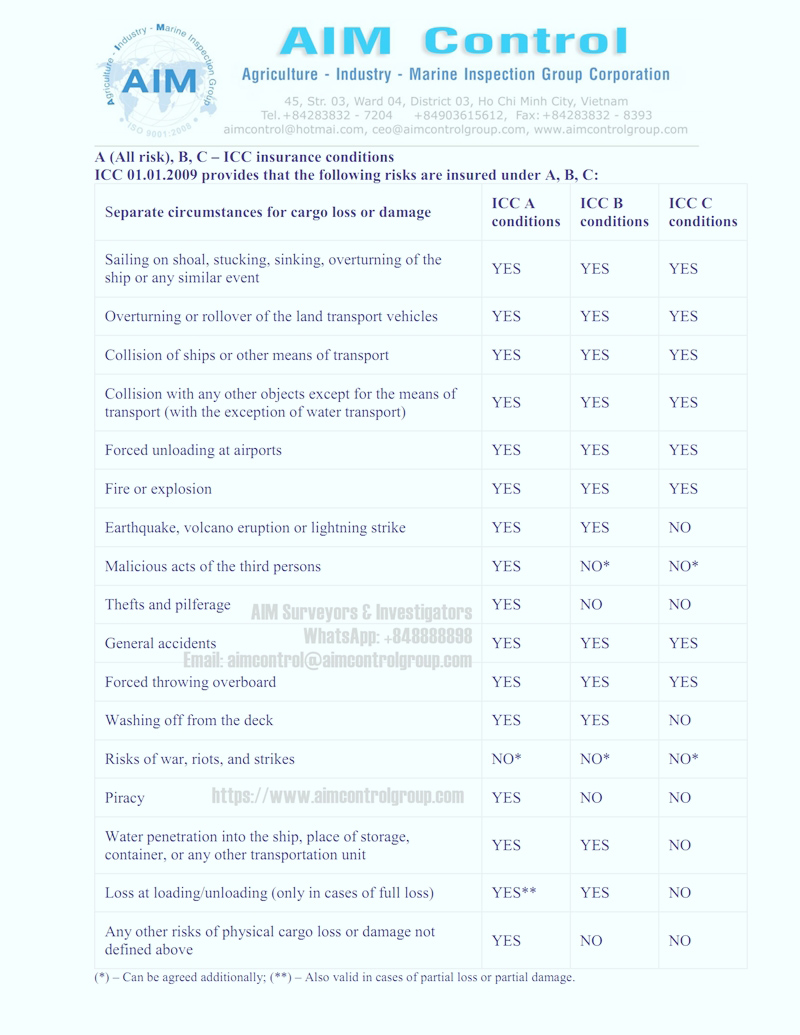

In the cargo insured package for shippers, most people will choose the all-risk insurance package (110% of the commercial value - all risk) or choose the insurance package that suits the needs of the exporter of the goods, the person who imports the goods (B, C ...). However, not everyone understands the insurance premium payment process and procedures to get an insurance policy quickly, ensuring full benefits later on.

In this article, the Agriculture Industry Marine Control Inspection Group of Companies AIM Control (AIM Group®)

Let's find out together!

Notice of accident (or loss) when incident occurs

When an accident occurs, the first thing you should do is stay calm and quickly contact the insurance company you have chosen to purchase for your shipment to report the accident.

You need to provide information such as followings:

The name of the company (the person named in the insurance policy / the insurance policy).

Name, phone number, email of the person notifying.

Goods, shipments, documents of shipments.

Container number, shipping vessel name.

Date, time, place and happenings.

Notice of loss or damage initially found.

(The phone number to contact is usually printed on the Certificate of Shipment Insurance - called a insurance policy).

Besides, please also contact and immediately notify the parties involved in the shipment such as shipping line agent, buyer, seller. . .Master, ship owner.

The AIM Group's surveyors who will be the insurance assessors or investigators for the shipment will quickly contact you and be on the site.

Note:

the Notice of Loss is a mandatory rule that you must follow to be able to ensure your benefits if you do not want to be sanctioned during the insurance implementation (sanction level: from 10 to 50% of the total amount). There are even cases where the insurance company will refuse to pay if you do not notify the insurance company when the loss occurs.

2. Initial accident handling steps

One of the principles to enjoy the shipment insurance is to keep the status of the loss and take pictures of the scene. This will ensure the accuracy of the details in the incident, protecting you from being partially denied under the insurance policy.

3. Shipment insurance claim inspection services:

In case the insured shipment has problems but due to the nature of the goods or products, such as hidden defects (from manufacturing), . . .then most likely you will not be compensated.

The insurance claim survey must be in the presence of AIM Group who is the authorized representative of the insurance company and the owner of the shipment (or the insured)/legal representative to determine the cause. and the extent of damage to the shipment (or subject matter insured).

Based on the loss estimate, the insurance company will consider whether to report to the local government to participate in the verification.

For loss of quality, volume and quantity estimated "below the insured deductible" or causes of loss other than those covered by the policy, the insurer shall monitor and notify Quick results for you.

For the estimated loss value from “above the insured deductible value”: the Surveyor of AIM Group must inspect and verify the site.

For the cause of shipment loss and / or damage from the shipping company or a third party: There must be a record of "a Joint survey" of AIM Group and concerned parties such as the representative of the company who caused the damage. (e.g. cargo is damaged in transit on board a ship, a representative of the shipping line is required).

In case the insured consignment has problems on the carrier, it is imperative that the shipper (or the representative named in the insurance policy) coordinate and follow the advice and instructions of AIM Group to solve the problem.

4. Xử lý bồi thường bảo hiểm lô hàng:

Sau khi tiến hành giám định lô hàng xác minh và chứng nhận những tổn thất, thiệt hại, AIM Group sẽ thông báo với khách hàng và công ty bảo hiểm sẽ tiến hành lựa chọn phương án bồi thường bảo hiểm vật chất sao cho thật hợp lý.

5. Rate of insurance compensation for damage /loss

In case of part loss

Insurers will normally limit indemnification for part loss as a percentage of the value of the shipment (or subject matter insured) according to the commercial invoice.

Specific examples like:

You are the owner of a shipment of a car with an actual value of USD 15 million. You have fully insured at the value of 110%. During the insurance period, your shipment unfortunately has an accident covered by the insurance. Damage is calculated according to repair costs including: Body shell is 2 million USD, engine is 5 million USD.

Based on the table of the ratio of the total value of the shipment (or the insured object) prescribed by the insurance company: The percentage of the total body shell is 50%, the percentage of the total cost of the engine is 30% and the rate of the total cost of components and other equipment is 10%. From there, you can easily get a rough estimate of the amount that the insurance company will pay for your shipment:

Shell body: 15 x 50% x110% = 8,25 million USD, which is more than 2 million USD, so the compensation amount for shell body: 2 million USD.

Engine: 15 x 30% x 110% = 4,95 million USD, less than 5 million USD, so the amount of Compensation for Engine: 5 million USD.

In case of total loss:

Total loss is calculated when your shipment happens to be: stolen, missing, damaged so badly that it can't be used, can't be bought or sold, or the cost of recovery is equal to or greater than the price. actual value of the shipment. Usually, the maximum amount of insurance claim is equal to the sum insured (Value x 110%) less the Exemption is usually the amount for which the loss is not covered. In other words, the deductible is the sharing of responsibility between the insurer and the insured.

.

In fact, insurance companies often stipulate that when the value of damage is equal to or greater than a certain percentage of the actual value of the insured object, it is considered an estimated total loss. However, there is always a limit.

Specifically: You participate in full insurance for 01 imported (or exported) shipment with the amount of equal to 100% of the actual value at a cargo insurance company. And under this insurance company and some international cargo insurance conventions, your lot is counted as an estimated total loss only when the value of the damage is equal to or as a percentage of the actual value of the lot. goods calculated on the table of the proportions of products and goods in the commercial invoice DEPENDING ON THE INITIAL INSURANCE BUYING CONDITIONS.

6. Completing the claim file

During the process of processing insurance claims, you need to follow and coordinate with the instructions of AIM Group's claim assessment staff so that the insurance unit handling the dossier can complete and close the claim usually the fastest and easiest way.

AIM accepts to provide the INSURANCE INSPECTION AND RECOMMENDATION services at the request of customers as follows:

Person holding an insurance policy (buying insurance)

-

Shipping ship owner

-

Logistic & Forwarder Company

-

State management unit

-

Insurance companies and insurance brokers

-

Commodity Import and Export Company

-

Another

Surveyors and Appraisers of Agriculture Industry Marine Control Inspection Corporation AIM Control (AIM Group®)

+ Having a university degree suitable to the requirements of the assessment field;

+ Having a professional certificate in the field of assessment as prescribed by law and having a professional certificate;

+ Having at least 20 to 50 years of working experience in the field of goods, shipping, maritime, ship and service of survey.

AIM Group is providing of services insurance loss survey includes activities to determine the current status, samples of goods, analysis at the lab., cause, extent of loss, calculation and distribution of liability for loss compensation as a basis for settlement of claims usually insured, witness of destroy and salvage.

AIM Group that directly conducts actuarial activities must also meet the standards of legal compliance, ethics, professional qualifications, experience in actuarial practice, membership of the Association of Professionals. international insurance calculation.

If you are interested in "Insurance appraisal and compensation process", please contact via phone number +84903 615 612 or hotline +848888889879 for the earliest support and advice.

EXPERTISE INDEPENDENT TRANSPARENCY